By order of the Board of Directors,  | |

| |

Mark A. Hampton | |

Executive Vice President, Secretary, | |

and Chief Financial Officer |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

Farmers Capital Bank Corporation |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

Farmers Capital Bank Corporation

202 West Main Street

Frankfort, Kentucky 40601

Notice of Annual Meeting of Shareholders

to be held May 14, 2013

April 1, 2013

Date: | Tuesday, May | ||

Time: | 11:00 a.m., Eastern Daylight Time | ||

Place: | Farmers Bank & Capital Trust Company 125 West Main Street Frankfort, Kentucky | ||

Purpose: | ● | To ratify the appointment of the independent registered public accounting firm, | |

● | To elect four directors, | ||

| and ● | |||

| To transact such other business as may properly come before the meeting | |||

Record Date: | Close of business on March 25, |

It is desirable that as many shareholders as possible be represented at the meeting. Consequently, whether or not you now expect to be present, please execute and return the enclosed proxy. You may revoke the proxy at any time before it is voted at the annual meeting of shareholders.

By order of the Board of Directors,  | |

| |

Mark A. Hampton | |

Executive Vice President, Secretary, | |

and Chief Financial Officer |

Your Vote Is Important

Please vote online, by telephone, or by signing, dating and returning your proxy card to us in the accompanying postage-paid envelope. |

Farmers Capital Bank Corporation

202 West Main Street

Frankfort, Kentucky 40601

Proxy Statement

Annual Shareholders’ Meeting-May 14, 2013

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Farmers Capital Bank Corporation (“Corporation”) for use at our Annual Meeting of Shareholders to be held on May 14, 2013,12, 2015, and at any adjournments (the “Meeting”).

*****Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be Held onMay 14, 2013*12, 2015*****

This proxy statement, the form of proxy,proxy, our Annual Report to ShareholdersShareholders and our Annual Report onon Form 10-K for the fiscal year ended December 31, 2012,2014, are available at www.farmerscapital.com.

Annual Report to Shareholders; Multiple Households

The 20122014 Annual Report to Shareholders, including financial statements, is being mailed to shareholders together with these proxy materials on or about April 1, 2013.2015. One annual report and one proxy statement are being delivered to multiple shareholders sharing an address unless we have received contrary instructions from one or more shareholders. Upon request, we will furnish the shareholder a separate copy of an annual report or proxy statement, as applicable. Requests should be directed to our corporate secretary at the address shown at the top of this page or by phone at 502-227-1668.

Who Can Vote

One Vote per Share; Outstanding Number of Shares.Each share of our common stock that you held on the record date entitles you to one vote at the Meeting. On the record date, there were 7,469,8137,490,158 shares of common stock outstanding.

Voting Rights

Votes Required.Our corporate secretary will count votes cast at the Meeting. Our directors are elected by the affirmative vote of a “plurality” of shares voted. A “plurality” means that the individuals with the largest number of votes are elected as directors up to the maximum number of directors (i.e., four) to be chosen at the Meeting. Under our bylaws, all other matters require the affirmative vote of the holders of a majority of the shares of our common stock present in person or by proxy at the Meeting, except as otherwise provided by statute, our articles of incorporation or our bylaws. Abstentions as to all such matters to come before the Meeting will not be counted as votes for or against and will not be included in calculating the number of votes necessary for approval of those matters.

Effect of Not Voting by Beneficial Owners; Broker Non-Votes.If your shares are held in a stock brokerage account, by a bank, broker, trustee, or other nominee, you are considered the beneficial owner of shares held in “street name”. Brokers holding shares in “street name” generally are not entitled to vote on certain matters unless they receive voting instructions from their customers. When brokers do not receive voting instructions from their customers, they notify us on the proxy form that they lack voting authority. The votes that could have been cast on the matter in question by brokers who did not receive voting instructions are called “broker non-votes”.

If you are a beneficial owner and do not provide voting instructions, your bank, broker or other holder of record is permitted to vote your sharesfor the ratification of our independent registered public accounting firm but isnot permitted tovote your shares on the election of directors, the endorsement of the compensation of our executives or the frequency of the compensation vote.directors.

Shares subject to broker non-votes will not be counted as votes for or against and will not be included in calculating the number of votes necessary for the approval of such matters to be presented at the meeting; however, shares represented by proxies containing both broker non-votes and a vote on any matter will be considered present at the annual meeting for purposes of determining the existence of a quorum.

Quorum

A quorum at the Meeting is a majority of the shares of our common stock entitled to vote present in person or represented by proxy. Shares of our common stock represented by properly executed and returned proxies will be treated as present. Shares of our common stock present at the Meeting that abstain from voting or that are the subject of broker non-votes will be counted as present for purposes of determining a quorum.

How Your Proxy Will Be Voted

The Board of Directors is soliciting a proxy in the enclosed form to provide you with an opportunity to vote on all matters scheduled to come before the Meeting, whether or not you attend in person.

Voting By Shareholders of Record. If.If at the close of business on March 25, 2013,2015, your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the shareholder of record of those shares and we have mailed these proxy materials to you. You may vote your shares by Internet, telephone, or by mail as further described below. Your vote authorizes each ofLloyd C. Hillard, Jr. and R. Terry Bennett as proxies, each with the power to appoint his or her substitute, to represent and vote your shares as you directed.

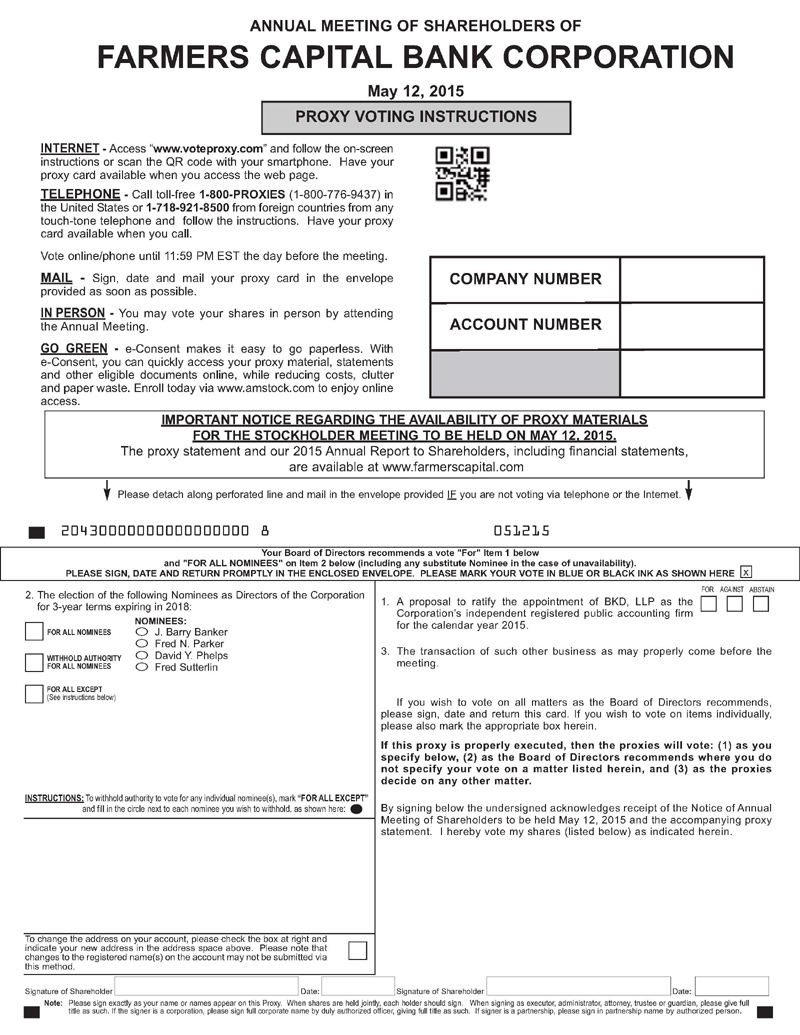

● | Vote by Internet – Access“ |

● | Vote by Telephone – Call toll-free1-800-PROXIES(1-800-776-9437) in the United States or1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. Have your proxy card available when you call. |

● | Vote by Mail – Mark, sign and date your proxy card and return it in the postage-paid envelope provided. |

Only the latest dated proxy received from you, whether by Internet, telephone or mail, will be voted at the Meeting. If you vote by Internet or telephone, please do not mail your proxy card.

Voting By Beneficial Owners of Record (“Street Name”). If.If at the close of business on March 25, 2013,2015, and if your shares are held in a stock brokerage account, by a bank, broker, trustee, or other nominee, you are considered the beneficial owner of shares held in street name. These proxy materials are being made available to you by your bank, broker, trustee or nominee that is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your bank, broker, trustee or nominee on how to vote your shares via the Internet or by telephone if the bank, broker, trustee or nominee offers these options or by signing and returning a proxy card. Your bank, broker, trustee or nominee will send you instructions for voting your shares.

If you wish to vote in person at the Meeting but hold your stock in street name (that is, in the name of a bank, broker, bank or other institution),then you must have a proxy from thebank,broker, bank or institution in order to vote at the meeting.

How YourProxies Will Be Voted..If you vote by Internet, telephone or by signing and returning the enclosed proxy card, your proxy will be voted in accordance with the instructions you provide. If you vote without providing contrary instructions, your proxy will be voted in the following manner:

● | for the ratification of the appointment of BKD, LLP as our independent registered public accounting firm for |

● | for the nominees for director as described in this proxy statement; and |

● | for |

The proxies being solicited may be exercised only at the Meeting and any adjournment and will not be used for any other meeting.

We expect no matters to be presented for action at the Meeting other than the items described in this proxy statement. If, however, you vote by Internet, telephone, or by signing and returning the enclosed proxy, you will give to the persons named as proxies therein discretionary voting authority with respect to any other matter that may properly come before the Meeting, and they intend to vote on any such other matter in accordance with their best judgment.

Revoking Your Proxy. If you submit a proxy, you may subsequently revoke it or submit a revised proxy at any time before it is voted. You may also attend the Meeting in person and vote by ballot, which would cancel any proxy that you previously submitted. If you wish to vote in person at the Meeting but hold your stock in street name (that is, in the name of a bank, broker, bank or other institution),then you must have a proxy from thebank,broker, bank or institution in order to vote at the Meeting.

No Appraisal Rights. Under Kentucky law, there is no appraisal or similar rights of dissenters with respect to any matter to be acted upon at the Meeting.

Directions to 20132015 Annual Meeting of Shareholders

Our Meeting will be held at 11:00 a.m., Eastern Daylight Time, on Tuesday, May 14, 201312, 2015 at Farmers Bank & Capital Trust Company, 125 West Main Street, Frankfort, Kentucky 40601. If you need directions, please contact our corporate secretary, C. Douglas CarpenterMark A. Hampton by calling 502-227-1668.

Proxy Solicitation

We will pay all of the expenses of this solicitation of proxies. Solicitations will be made by the use of mails, except that proxies may be solicited by telephone by our directors and officers. We do not expect to pay any other compensation for the solicitation of proxies, but will reimburse brokers and other persons holding our common stock in their names, or in the name of nominees, for their expenses in sending proxy materials to their principals.

Shareholders’ Proposals for 20142016 Annual Meeting

We presently contemplate that the 20142016 Annual Meeting of Shareholders will be held on or about May 13, 2014.10, 2016. If you want us to consider including a proposal in next year’s proxy statement, you must deliver it in writing no later than December 2, 20133, 2015 (the date 120 days prior to the first anniversary of the date of the 20132015 annual meeting proxy statement) to: Secretary, Farmers Capital Bank Corporation, 202 West Main Street, Frankfort, Kentucky 40601, Attention: C. Douglas Carpenter, Secretary.Mark A. Hampton. We recommend that you send any proposals by certified mail, return receipt requested.

If you want to present a proposal at next year’s Annual Meeting but do not wish to have it included in our proxy statement, you do not need to contact us in advance. Our bylaws do not contain any requirement for shareholders to provide advance notice of proposals or nominations they intend to present at the Meeting. However, if you do not notify us on or before February 15, 201416, 2016 of any matter that you wish to present at next year’s annual meeting, then the shareholders’ proxies that we solicit in connection with our 20142016 Annual Meeting of Shareholders will confer on the proxyholders’ discretionary authority to vote on the matter that you present at our 20142016 Annual Meeting.

Corporate Governance

Code of Ethics. Ethical business conduct is a shared value of our Board of Directors, management and employees. Our Code of Ethics applies to our Board of Directors as well as all employees and officers, including the principal executive officer and principal financial and accounting officer.

Our Code of Ethics covers all areas of professional conduct, including, but not limited to, conflicts of interest, disclosure obligations, insider trading and confidential information, as well as compliance with all laws, rules and regulations applicable to our business. We encourage all employees, officers and directors to promptly report any violations of the Code of Ethics to the appropriate persons identified in the Code. A copy of our Code of Ethics is available at our website under the tab entitled: “Corporate Policies” at the following address: www.farmerscapital.com.

Board Structure and Committees. As of the date of this proxy statement, our Board of Directors consists of twelve members. We also have twoone advisory directorsdirector who dodoes not vote. Our Board of Directors held seveneight meetings during 2012.2014. All directors attended at least 75% of the total number of board meetings and the meetings of the committees to which they belonged. Our Board of Directors does not have a specific policy for director attendance at our annual meeting of shareholders. All directors attended our 20122014 annual meeting.

Our Board of Directors has a standing Audit Committee, and Compensation Committee but does not haveand a standing nominating committee. The Executive Committee performs the functions of a nominating committee.

Audit Committee | Meetings | |||||

Members | Functions of the Committee | in | ||||

David R. O’Bryan J. Barry Banker | • | Monitors the integrity of our financial reporting process and systems of internal controls regarding finance, accounting, and legal compliance | 4 | |||

Dr. William C. Nash | • | Selects our independent registered public accounting firm and determines such auditor’s compensation | ||||

Fred N. Parker | • | Monitors the independence and performance of the independent registered public accounting firm, management and the internal audit department | ||||

• | Oversees the establishment and investigation of complaints regarding accounting, internal accounting controls or audit matters | |||||

• | Provides an avenue of communication among the independent registered public accounting firm, management, the internal audit department and the Board of Directors | |||||

• | Pre-approves, if appropriate, all related party transactions | |||||

Compensation | ||||||

Meetings | ||||||

Committee Members | Functions of the Committee | in | ||||

J. Barry Banker Dr. William C. Nash Fred N. Parker David Y. Phelps | • | Please refer to the sections in this proxy statement entitled “Compensation Discussion and Analysis” and the “Report of the Compensation Committee” | ||||

3 | ||||||

Nominating | Meetings | |||||

Committee Members | Functions of the Committee | in 2014 | ||||

R. Terry Bennett (Chairman) J. Barry Banker Michael J. Crawford Judy Worth | • | To recommend director nominees who can best perpetuate the success of the business | 1 | |||

Committee Charters. Only ourBoth the Audit Committee has a charter,and the Compensation Committee have charters, which isare available under the tab entitled “Corporate Policies” at our website at the following address: www.farmerscapital.com. Our Audit Committee wasBoth committees were in compliance during 20122014 with itstheir written charter. The Board of Directors does not limit the number of audit committees for other corporations on which its audit committee members may serve. NoneMr. Parker is the only member of the audit committee members currently serveserving on anotherthe audit committee for aanother publicly-held entity.

Board and Committee Independence. The Board has determined that each of its members is independent as defined by the rules of NASDAQ, except for Mr. Sutterlin and its employee director Mr. Hillard. Further, our Board has determined that Mr. Bennett and Mr. Crawford are both independent under the rules of NASDAQ after considering the Corporation’s 2014, 2013 and 2012 payments to both a law firm and a real estate company of which Mr. Bennett is a partial owner and insurance commissions

paid during 2014, 2013 and 2012 to the insurance agency of which Mr. Crawford was a partial owner. The aggregate amountamounts the Corporation paid to each of Mr. Bennett’s and Mr. Crawford’s companies were below the $120,000 threshold set by NASDAQ. However, Mr. Sutterlin is not considered independent due to the fact that he received $139,601 in 2012 in the normal course of business involving the sale of a significant piece of repossessed real estate and fees related to the management of two other pieces of repossessed real estate.

Audit Committee Financial Expert. Our Board of Directors has determined (in accordance with Securities and Exchange Commission Regulation S-K 407(d)) that Mr. O’Bryan satisfies the qualifications of financial expert and Mr. O’Bryan accordingly has been designated as the Audit Committee financial expert. The Board has also determined that Mr. O’Bryan is independent as defined by the rules of NASDAQ for audit committee members.

Consideration of Director Nominees. We do not have a standingA nominating committee; the Executive Committee, consisting of Mr. Bennett, Mr. Banker, Dr. Nash and Ms. Sweeney, performs the functions of a nominating committee.committee was created in October 2013. All four of the members of the ExecutiveNominating Committee are independent directors under NASDAQ rules. They determine the nominees for director to be presented for election based upon their review of all proposed nominees for the Board, including those proposed by shareholders. The ExecutiveNominating Committee selects qualified candidates based upon the criteria set forth below and reviews their recommendations with the full Board, which decides whether to invite the candidate to be a nominee for election to the Board. The Board desires to maintain a diversity of experiences and skills in the members that represent the shareholders.

The factors to be considered, include, but are not limited to, the following (collectively, the “Evaluation Guidelines”):

1. | Decisions for recommending candidates for nomination shall be based on merit, education, qualifications, performance, character, professionalism, integrity, and the Company’s business needs and shall comply with the Corporation’s anti-discrimination policies and federal, state and local laws; |

2. | The composition of the entire Board shall be taken into account when evaluating individual directors, including: the diversity, depth and breadth of knowledge, skills, perspective, experience and background represented on the Board; the need for financial, business, financial industry, public company, diversity and other experience and expertise on the Board and its committees; and the ability and willingness to work cooperatively with other members of the Board and with senior management of the Corporation to further the interests of the Corporation and its shareholders; |

3. | Candidates shall be free of conflicts of interest that would interfere with their ability to discharge their duties as director; |

4. | Candidates shall be willing and able to devote the time necessary to discharge their duties as a director and shall have the desire and purpose to represent and advance the interests of the Corporation and shareholders as a whole; |

5. | In determining whether to recommend a director for re-election, the Nominating Committee shall consider the director’s past attendance at meetings and participation in and contributions to the activities of the Board; and |

6. | The Nominating Committee may determine any other criteria. |

For a shareholder to submit a candidate for consideration as a director, a shareholder must notify our corporate secretary. To be considered for nomination and inclusion in our proxy statement at the 20142016 Annual Meeting, a shareholder must notify our corporate secretary no later than December 2, 20133, 2015 (the date 120 days prior to the first anniversary of the date of the 20132015 annual meeting proxy statement). Notices should be sent to: Farmers Capital Bank Corporation, 202 West Main Street, Frankfort, Kentucky 40601, Attention: C. Douglas Carpenter,Mark A. Hampton, Secretary.

Executive Sessions of the Board. Independent directors meet in executive sessions without management and non-independent directors. Executive sessions are held at least twice annually in conjunction with regularly scheduled board meetings.

Communications with the Board. Our Board of Directors has established a process for shareholders to communicate with the Board or an individual director. Shareholders may contact the Board or an individual director by writing to the attention of one or more directors at our principal executive offices at 202 West Main Street, Frankfort, Kentucky 40601, Attention: C. Douglas Carpenter,Mark A. Hampton, Secretary. Each communication intended for the Board of Directors or an individual director will be forwarded to the specified party.

Board Leadership Structure and Role in Risk Oversight

We are a bank holding company that was formed in 1982 under the Bank Holding Company Act of 1956, as amended. We are the parent company for four separately chartered commercial bank subsidiaries and sixfive separate non-bank subsidiary companies.

Our Board is currently comprised of ten independent directors, one director that is not independent due to the amount of compensation received in 2012 and one employee director. We are committed to a strong, independent Board and believe that objective oversight of the performance of our

Our Chairman is an independent director and has the following duties:

● | Chair and preside at Board meetings; |

● | Coordinate with our CEO in establishing the annual agenda and topic items for Board meetings; |

● | Advise on the quality, quantity and timeliness of the flow of information from management to the Board; |

● | Act as principal liaison between management and the Board on sensitive issues; |

● | Retain independent advisors on behalf of the Board as the Board may determine is necessary or appropriate; and |

● |

Provide an important communication link between the Board and shareholders, as appropriate. |

Our Board of Directors, together with the Audit and Compensation Committees of the Board, coordinate with each other to provide enterprise-wide oversight of our management and handling of risk. These committees report regularly to the entire Board of Directors on risk-related matters and provide our Board of Directors with integrated insight about our management of strategic, credit, interest rate, financial reporting, technology, liquidity, compliance, operational and reputational risks.

In addition, each of our subsidiaries have their own board of directors, and each bank subsidiary has audit and asset liability management committees, both of which provide risk management at each of their respective companies. Our CEO serves on the board of each directly owned subsidiary. One of the key responsibilities of each subsidiary board is to manage strategic, credit, interest rate, financial reporting, technology, liquidity, compliance, operational and reputational risks. Our Board of Directors believes that sound credit underwriting to manage credit risk and a conservative investment portfolio to manage liquidity and interest rate risk contribute to an effective oversight of the Corporation’s risk and we require our subsidiaries to follow this philosophy.

The structure of separate chartered banks allows each bank the ability to operate quickly and efficiently without going through unnecessary levels of management. The structure of internal controls, processes and examinations allow the necessary oversight and protection. Our Board of Directors and each subsidiary board of directors meet on a regular basis and are presented reports from management to evaluate performance and the opportunity to relay refined directions. Our structure gives us a competitive advantage over larger financial institutions with less hometown connection and unwieldy chains of command.

Principal Beneficial Owners

The following table gives information as to all persons or entities haveknown to us to be beneficial ownershipowners of more than five percent (5%) of the shares of our common stock.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership of Corporation Common Stock | Percent of Class |

Basswood Capital Management Matthew Lindenbaum Bennett Lindenbaum 645 Madison Avenue, 10th Floor New York, NY 10022 | 740,5661 | 9.891 |

1 Based on the Schedule 13G/A filed with the SEC on February 17, 2015, Basswood, Matthew Lindenbaum and Bennett Lindenbaum share voting power and dispositive power as to 740,566 shares of our common stock outstanding as of December 31, 2014.

Report of the Audit Committee

General.

General.The Audit Committee is currently made up of fourfive non-employee directors. All members of the Audit Committee are independent directors as defined by the rules of NASDAQ. We operate under a written charter approved by our committee and adopted by the Board of Directors.

We review the Corporation’s financial reporting process on behalf of our Board. The Audit Committee’s responsibility is to monitor this process, but the Audit Committee is not responsible for preparing the Corporation’s financial statements or auditing those financial statements. Those are the responsibilities of management and the Corporation’s independent registered public accounting firm, respectively.

Financial Statement Review. BKD, LLP (“BKD”) was the Corporation’s independent registered public accounting firm for 2012.2014. We have reviewed and discussed the Corporation’s audited consolidated financial statements for the year ended December 31, 20122014 with management and BKD. Management represented to us that the audited consolidated financial statements fairly present, in all material respects, the financial condition, results of operations and cash flows of the Corporation as of and for the periods presented in the consolidated financial statements in accordance with accounting principles generally accepted in the United States, and BKD provided an unqualified audit opinion to the same effect.

BKD has provided us with written assurance of its independence (as required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the audit committee concerning independence). We also met with BKD and discussed BKD’s independence, the results of its audit and other matters required to be discussed by applicable accounting standards (including Statement on Auditing Standards No. 61, 16,Communications with Audit Committees, as amended).

In addition, we have discussed with BKD the overall scope and plans for their audit, and have met with them and management to discuss the results of their examination, their understanding and evaluation of the Corporation’s internal controls they considered necessary to support their opinion on the consolidated financial statements for the year ended December 31, 2012,2014, and various factors affecting the overall quality of accounting principles applied in the Corporation’s financial reporting. BKD also met with us without management being present to discuss these matters.

We have considered whether the provision of services to the Corporation by BKD, beyond those rendered in connection with the audit and review of consolidated financial statements, is compatible with maintaining the independence of such firm.

In reliance on these reviews and discussions, we recommended to the Board of Directors, and the Board of Directors approved, the inclusion of the audited financial statements referred to above in the Corporation’s annual report on Form 10-K for the fiscal year-ended 20122014 to be filed with the SEC.

Dated: March 7, 2013

David R. O’Bryan, Audit Committee Chairman J. Barry Banker Dr. William C. Nash Fred N. Parker Marvin E. Strong, Jr. |

Fees ofIndependentRegistered Public Accounting Firm

Pre-approval Policies and Procedures. Except as set forth in the next paragraph, the Audit Committee’s policy is to approve in advance all audit fees and terms and non-audit services permitted by law to be provided by the independent registered public accounting firm. In accordance with that policy, the committee annually pre-approves a list of specific services and categories of services, including audit, audit-related and non-audit services described below, for the upcoming or current fiscal year, subject to specified cost levels. Other services include:

1. Consultation regarding financial accounting and reporting standards;

2. Discussions related to accounting for a proposed acquisition;

3. Discussions regarding regulatory requirements;

4. Consultation concerning tax planning strategies; and

5. Assistance with tax examinations.

The Audit Committee has authorized the Audit Committee Chairman, David R. O’Bryan or the Vice Chairman of the Board of Directors (who is also an Audit Committee member), R. Terry Bennett,J. Barry Banker, to approve additional funds on behalf of the Audit Committee if the independent auditors need to perform additional work which had not been previously approved.

At each regularly-scheduled Audit Committee meeting, management updates the committee on the scope and anticipated cost of (1) any service pre-approved by the Audit Committee Chairman or

Fees and Related Disclosures for Accounting Services. The fees for services provided by the independent registered public accounting firm, BKD for 2012 and Crowe Horwath LLP for 2011, were as follows:

Audit fees - Fees for the Corporation’s audit of the annual consolidated financial statements and the review of the Corporation’s Form 10-Qs were $101,775$256,950 for 20122014 and $199,000$249,400 for 2011.2013.

Audit related fees - Aggregate fees for all assurance and related services were $5,134none for 20122014 and $500none for 2011. These fees were incurred for consulting on accounting topics.2013.

Tax fees - Fees related to tax compliance, advice and planning were none$46,700 for 20122014 and $71,500$45,300 for 2011.2013. These fees were incurred for tax preparation services and consulting on tax related compliance and strategies.

All other fees - $31,333None for 20122014 and $2,491none for 2011. The 2012 fees result from consent work for the US Treasury’s auction of our preferred stock. These fees for 2011 are related to an accounting research database subscription.2013.

All services provided by the independent registered public accounting firmsfirm in 20122014 and 20112013 were approved by the Audit Committee. All fees were approved in accordance with the pre-approval policy. The Audit Committee has determined that the provision of the services described above is compatible with maintaining independence.

PROPOSAL NO.1

Ratification of IndependentRegistered Public Accounting Firm

Our Audit Committee and Board seek shareholder ratification of the appointment of BKD to act as the independent auditorsauditor of our consolidated financial statements for the fiscal year ending December 31, 2013.2015. If the shareholders do not ratify the appointment of BKD, our Audit Committee and Board will reconsider this appointment for 2014.2016. BKDwill have one or more representatives at the Annual Meeting who will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.OurBoard of Directors recommends voting FOR this proposal.

.Directors

Classified Board Structure; Term; Vacancies. In accordance with our articles of incorporation, our Board of Directors is classified into three classes as nearly equal in number as the then total number of directors constituting the whole Board permits. Each class is to be elected to separate three (3) year terms with each term expiring in different years. At each annual meeting the directors or nominees constituting one class are elected for a three (3) year term. All four of our director nominees are currently serving on our Board and their term expires at the annual meeting on May 14, 2013.12, 2015 and our Nominating Committee recommends them for re-election. If elected, the four director nominees will serve until the Annual Meeting of Shareholders in 2016.2018. Any vacancies that occur after the directors are elected may be filled by the Board of Directors in accordance with law for the remainder of the full term of the vacant directorship.

Director Qualifications. Our Board of Directors consists of twelve members who are well-qualified to serve on our Board and represent our shareholders’ best interests. Our nominees are selected with a view of establishing a board of directors that meet the criteria for qualified candidates that is set forth above under the caption “Consideration of Director Nominees.” We believe that each of the director nominees and other directors bring these qualifications to our Board of Directors. Together, our director nominees and continuing directors provide our Board with a diverse complement of specific business skills, experience and perspectives, including: extensive financial and accounting expertise, knowledge of the commercial banking industry, experience with companies that serve the same communities that our bank subsidiaries serve, and extensive operational and strategic planning experience. The following describes the key qualifications, business skills, experience and perspectives that each of our directors brings to the Board of Directors, in addition to the general qualifications under “Consideration of Director Nominees” and information included in the biographical summaries provided below for each director. We believe that each individual’s skills and perspectives strengthen our Board’s collective qualifications, skills and experience.

Name | Key Qualifications |

J. Barry Banker | Mr. Banker has extensive financial, management, marketing, operational and strategic planning experience from serving as the Manager for a boarding school for |

| Name | Key Qualifications |

R. Terry Bennett | Mr. Bennett, an attorney in private practice since 1974, has comprehensive experience in a broad range of legal, regulatory and business issues and in-depth knowledge of the local communities we serve because of his service on numerous local boards of various civic and professional organizations. He also brings significant management skills and knowledge of economic development from his former position as public liaison between Fort Knox, KY and Hardin County, KY for the Base Realignment Act. |

Michael J. Crawford | Mr. Crawford brings extensive risk management skills and general business experience to our Board through his career as selling and providing comprehensive insurance to his clients and managing an insurance company. He was also instrumental in forming a successful de-novo bank in 1993, which the Corporation acquired 12 years later. |

John R. Farris | Mr. Farris has significant economic and financial experience from consulting with municipalities, performing bond underwriting analysis and from business development within the public and private sector. Based upon these experiences and from his experience serving as a senior policy director of Center for Responsible Lending, a senior economics consultant for The World Bank and as Deputy Secretary and Secretary, Finance Administration for the Commonwealth of Kentucky, Mr. Farris provides our Board with both global and local perspectives regarding our operations and strategic growth opportunities. |

Lloyd C. Hillard, Jr. | Mr. Hillard’s extensive banking career (beginning in 1964), his significant executive management experience in the banking industry and extensive financial expertise including experience as CFO of a previous banking organization, his knowledge of local communities, including through service on numerous local and national boards of various civic and professional organizations, and his in-depth knowledge of the Corporation’s business, strategy and management team make him highly qualified to lead us and to serve as our CEO. |

Dr. William C. Nash | As a retired Army Medical Corps Colonel, Dr. Nash brings a unique perspective to our Board. His successful record of |

David R. O’Bryan, CPA | Mr. O’Bryan’s |

Fred N. Parker, CPA, CFA | Mr. Parker has been employed by a coal and real estate company for the past |

| Name | Key Qualifications |

David Y. Phelps |

Mr. Phelps has been an innovator, founder and manager of businesses in the heavily regulated life science field. He also has numerous patents to his credit. One of the companies Mr. Phelps managed was recognized as an INC 500 company. He also has been a recipient of the Ernst & Young Entrepreneur Of The Year® Award. Mr. Phelps brings an entrepreneurship perspective and extensive management experience to our Board. | |

Marvin E. Strong, Jr. | Mr. Strong brings substantial economic and business development skills to our Board through his experience as a partner of a domestic and international business consulting firm and his experience as Secretary, Economic Development Cabinet, for the Commonwealth of Kentucky. |

Fred Sutterlin | Mr. Sutterlin’s background in law, real estate and banking, and his demonstrated experience as a small business owner are directly beneficial to the leadership of our company. During his career, he has worked at a large banking company, a regional law firm, and founded several businesses, including a regional commercial and investment real estate company. Additionally, Mr. Sutterlin understands and is sensitive to our community issues; in part because of his extensive leadership experiences with numerous organizations within our footprint. |

Judy Worth | Ms. |

Independence of Directors. In accordance with rules of NASDAQ, all of the nominees for director, and all continuing directors listed below, meet the NASDAQ definition of “independent” except for Mr. Hillard and Mr. Sutterlin.

ELECTION OF DIRECTORS

Our Board of Directors intends to nominate for election as directors the four (4) persons listed below. It is the intention of the persons named in the proxy to vote for the election of all nominees named. If any nominee(s) shall be unable to serve, which is not now contemplated, the proxies will be voted for such substitute nominee(s) as our Board recommends. Nominees receiving the four (4) highest totals of votes cast in the election will be elected as directors. Proxies in the form solicited hereby that are returned to us will be voted in favor of the four (4) nominees specified below unless otherwise instructed by the shareholder. Abstentions and shares not voted by brokers and other entities holding shares on behalf of beneficial owners will not be counted and will have no effect on the outcome of the election.

The following tables set forth information with respect to each nominee for director, and with respect to continuing directors who (by virtue of the classes in which they serve) are not nominees for re-election at the Meeting.

Nominees for Three-Year Terms Ending in 2016

Name and Age | Year First Elected Director | Position and Offices with Corporation1 | Business Experience |

J. Barry Banker (63) | 1996 | Vice Chairman of the Board of Directors | Manager/CEO of Stewart Home School (private, special needs home and school) |

Fred N. Parker, CPA, CFA (61) | 2012 | Director | President and CEO of Kentucky River Coal Corporation |

David Y. Phelps (56) | 2012 | Director | President and CEO of CreoSalus (pharmaceutical research and manufacturing) |

Fred Sutterlin (44) | 2012 | Director | CEO & Chairman of PRG Investments since 2011, Managing Principal & General Counsel from 2004 until 2011. |

Continuing Directors Whose Terms Expire in 2016

Name and Age | Year First Elected Director | Position and Offices with Corporation1 | Business Experience |

R. Terry Bennett (69) | 2007 | Chairman of the Board of Directors; Director of First Citizens Bank (“First Citizens”) | Attorney, Skeeters, Bennett, Wilson & Pike |

Michael J. Crawford (59) | 2010 | Director; Chairman of the Board of Directors of Citizens Bank of Northern Kentucky (Newport, KY) (“Citizens Northern”) | Managing Director of AssuredPartners of Kentucky since October 2012, President and Director of Crawford Insurance (a life, health, individual and commercial insurance agency) from 1995 until October 2012 when the business was purchased by AssuredPartners |

Lloyd C. Hillard, Jr. (68) | 1996 | Director; President and CEO of Corporation since January 2010; President and CEO of First Citizens from 1992- 2010; Director of: Farmers Bank & Capital Trust Company (“Farmers Bank”), United Bank & Trust Co. (Versailles) (“United Bank”), First | See experience listed under the immediately preceding column of this table. |

Dr. William C. Nash | 2010 | Director; Chairman of the Board of Directors of First Citizens | Orthopaedic Surgeon |

Continuing DirectorsDirectors Whose Terms Expire in 2014

Name and Age | Year First Elected Director | Position and Offices with Corporation1 | Business Experience |

John R. Farris (42) | 2011 | Director | President, Commonwealth Economics, LLC since 2007 (a business development and consulting firm); Secretary/Deputy Secretary, Finance and Administration Cabinet, Commonwealth of Kentucky 2004-2007 |

David R. O’Bryan, CPA | 20102 | Director; | Retired Director of Blue & Co., LLC since |

Marvin E. Strong, Jr. | 2008 | Director; | Partner, McCarty-Strong Global Consulting, LLC since 2007 (a business development and consulting firm); Secretary, Economic Development Cabinet, Commonwealth of Kentucky 1993-2007 |

Judy Worth (67) | 2014 | Director | Partner, Verble, Worth & Verble since 1982 (an organizational and human resource development firm) |

1All corporations listed in this column other than this Corporation are our subsidiaries.

2Appointed in 2010 to fill an unexpired term

3 J. Barry Banker is the son-in-law of Dr. John P. Stewart, an advisory director (and Chairman Emeritus) of the Corporation. Fred Sutterlin is the son of Dr. John D. Sutterlin, who serves as Chairman of the Board of Farmers Bank. The two foregoing are the only “family relationships” between any director (or advisory director), executive officer, or person nominated or chosen to become a director or executive officer of the Corporation. “Family relationship” means a relationship by blood, marriage or adoption not more remote than first cousin.

Advisory DirectorsDirector. In addition to the nominees and continuing directors listed in the tables above, E. Bruce Dungan and Dr. John P. Stewart serveserves as advisory directorsdirector to the Corporation.

Retirement Policy. The retirement policy for our non-employee directors (which was revised January, 2012) provides that a director shall retire effective as of the end of his or her elected term next following the date on which the director attains age 70. There is no age limitation on the eligibility of the

Prior to January 1, 2004, any suchretiring director could, at the discretion of the Board of Directors, become an advisory director. Effective January 1, 2004, persons then serving as advisory directors (including

(including the two advisory directorsdirector listed above) may continue to serve in such capacity only at the discretion of the Board of Directors.

The Corporation Board of Directors recommends voting FOR the election of each of the Nominees for Director..

Stock Ownership of Directors and Executive Officers

The table below contains information as to the shares of our common stock beneficially owned by all directors (and director nominees), advisory directors and executive officers, and by all such persons as a group. Unless otherwise indicated, all shares are owned directly and the named persons possess both sole voting power and sole investment power. Unless otherwise indicated, none of the shares have been pledged as security.

| Name | Amount and Nature of Beneficial Ownership of Corporation Common Stock as of March 7, 20151 | Percent of Class2 | ||||||||||

J. Barry Banker | 10,543 | 3 | .14 | |||||||||

R. Terry Bennett | 16,949 | 4 | .23 | |||||||||

Scott T. Conway | 558 | 5 | .01 | |||||||||

Michael J. Crawford | 30,334 | 6 | .40 | |||||||||

E. Bruce Dungan | 77,060 | 7 | 1.03 | |||||||||

John R. Farris | 14,028 | 8 | .19 | |||||||||

James L. Grubbs | 33 | 9 | .00 | |||||||||

Mark A. Hampton | 205 | 10 | .00 | |||||||||

Rickey D. Harp | 11,064 | 11 | .15 | |||||||||

Lloyd C. Hillard, Jr. | 17,546 | 12 | .23 | |||||||||

Dr. William C. Nash | 6,962 | 13 | .09 | |||||||||

David R. O’Bryan | 2,962 | 14 | .04 | |||||||||

Fred N. Parker | 31,705 | 15 | .42 | |||||||||

David Y. Phelps | 5,062 | 16 | .07 | |||||||||

Marvin E. Strong, Jr. | 3,490 | .05 | ||||||||||

Fred Sutterlin | 1,706 | 17 | .02 | |||||||||

| �� | ||||||||||||

Judy Worth | 1,252 | .02 | ||||||||||

| Amount and Nature of Beneficial Ownership of Corporation Common | |||

| Name | Stock as of March 7, 2013 1, 2 | Percent of Class 1, 2 | |

| J. Barry Banker | 5,611 | 3 | .08 |

| R. Terry Bennett | 13,469 | 4 | .18 |

| C. Douglas Carpenter | 4,483 | 5 | .06 |

| Scott T. Conway | 350 | .00 | |

| Michael J. Crawford | 29,922 | 6 | .40 |

| E. Bruce Dungan | 77,060 | 7 | 1.03 |

| John R. Farris | 9,659 | 8 | .13 |

| James L. Grubbs | - | .00 | |

| Rickey D. Harp | 20,859 | 9 | .28 |

| Lloyd C. Hillard, Jr. | 15,331 | 10 | .21 |

| Dr. William C. Nash | 8,000 | 11 | .11 |

| David R. O’Bryan, CPA | 2,550 | 12 | .03 |

| Fred N. Parker | 29,293 | 13 | .39 |

| David Young Phelps | 2,000 | .03 | |

| Dr. John P. Stewart | 16,850 | 14 | .23 |

| Marvin E. Strong, Jr. | 2,078 | .03 | |

| Fred Sutterlin | 1,293 | 15 | .02 |

| Shelley S. Sweeney | 150,821 | 2.02 | |

| All Directors (and Nominees), | 388,129 | 16 | 5.21 |

| Advisory Directors and Executive | |||

| Officers as a group |

All Directors (and Nominees),Advisory Directors and Executive Officers as a group | 226,740 | 3.03 |

1 | All entries are based on information provided to the Corporation by its directors, director nominee, advisory |

2 | Based on 7,490,158 shares of our common stock |

3 | Includes 1,000 shares owned by Mr. Banker’s wife, 404 shares held in an IRA for the benefit of Mr. Banker and |

4 | Includes 1,000 shares owned by Mr. Bennett’s wife, |

5 | Includes |

6 | Includes 29,922 shares |

7 | Includes 43,600 shares owned by Mr. Dungan’s wife and 1,460 shares held in an IRA for the benefit of Mr. Dungan. |

8 | Includes |

9 | Shares held by the ESPP for his benefit. |

10 | Includes 105 shares held by the ESPP for his benefit. |

11 | Includes 1,870 shares owned jointly with Mr. Harp’s wife, 1,063 shares held in an IRA for the benefit of Mr. Harp and |

12 | Includes |

13 | Includes 3,000 |

14 | Includes 1,050 shares owned jointly with Mr. O’Bryan’s wife and 1,500 shares held in an IRA for the benefit of Mr. O’Bryan. |

15 | Includes 21,190 shares owned jointly with Mr. Parker’s wife, 4,900 shares owned by Mr. Parker’s wife, |

16 | Includes 2,200 shares held in an IRA for the benefit of |

17 | Includes 200 shares held in a SEP retirement account for Mr. Sutterlin’s benefit. |

Executive Compensation

Compensation Discussion and Analysis

IntroductionIntroduction: We are committed to providing excellent banking service in a friendly hometown fashion while at the same time maximizing equity value for our shareholders. Accordingly, our goal is to hire and retain dedicated and exceptional people that will help us grow in terms of banking locationsdevelop and deliver our products. Toward this goal, we have designed and implemented our compensation programs for our named executive officers to reward them for sustained financial and operating performance and leadership

excellence, to align their interests with those of our shareholders and to encourage them to remain with us for long and productive careers. Our compensation elements simultaneously fulfill one or more of our performance, alignment and retention objectives.

Compensation Philosophy: While we are committed to hiring the best individuals at all levels of our institutions, in order for us to succeed in the banking industry it is particularly vital that dedicated and exceptional people serve on our executive management team. We view our executive management team as consisting of seven (7) individuals (including our “named executive officers” in the “Summary Compensation Table” below). Our compensation programs are designed to attract and retain the most capable executives while motivating these individuals to continue to enhance shareholder value. While the Compensation Committee has the power to modify the compensation programs, our overall compensation philosophy has remained consistent with these objectives. We believe the most important indicator of whether our compensation objectives are being met is our ability to motivate our named executive officers to deliver superior performance and retain them to continue their careers with us on a cost-effective basis.

Our compensation programs in recent years have been relatively simple and rely chiefly on currently paid compensation (principally salary). Our practice in that regard has been solidified of late due to our most recent acquisitions (including our acquisitions of Citizens Bancorp, Inc. and Citizens National Bancshares, Inc.) and the attendant challenge of merging various cultures (including compensation cultures).

Effect of Nonbinding Shareholder Advisory Vote:Last yearAt our 2013 shareholder meeting, we asked our shareholders for a non-binding advisory vote on two items. The first was to approve the programs and procedures related to our executive compensation. While the shareholder vote was not binding, our Board did review and consider the voting results. Ninety-twoNinety-three percent of the votes cast were in favor of our compensation programs and procedures. As a result, we determined that we did not need to consider changing our overall approach to executive compensation.

The second item was on the frequency of the advisory vote on the Corporation’s overall executive compensation programs. The majority of the votes cast were in favor of holding the advisory vote every three years. As such, the next advisory vote on the Corporation’s overall executive compensation programs will be at the 2016 annual meeting of shareholders.

Participation in the Capital Purchase Program:On January 9, 2009, we entered into an agreement with the United States Department of the Treasury (the “Treasury”) under its TARP Capital Purchase Program (“CPP”) by which we sold to the Treasury shares of our Fixed Rate Cumulative Perpetual Preferred Stock, Series A (“Preferred Stock”), and a warrant to purchase shares of our common stock (“Warrant”). As a result of participating in the CPP, some of our officers were subject to restrictions upon executive compensation imposed by the Emergency Economic Stabilization Act of 2008 (“2008 Act”), as amended, and the regulations issued thereunder by the Treasury (the “CPP Restrictions”).

In June 2012 the Treasury sold their entire ownership interest in the Corporation. As a result of the sale, we are no longer subject to the CPP Restrictions on executive compensation, including the prohibition on making (1) payments to executives upon their departure from the Corporation for any reason or due to a change in control of the Corporation; and (2) payments to executives of cash bonuses.

Compensation Components: Total compensation for each member of our executive management team consists of (a) currently paid compensation components consisting of salary, discretionary bonuses and perquisites and (b) long-term components which include discretionary distributions to our Salary Savings Plan and the ability of our executives (as well as all our employees) to acquire our common stock in a favorable manner (from a financial and tax perspective) under our Employee Stock Purchase Plan (“ESPP”). Base salary is established to be commensurate with the executive’s scope of responsibilities,

demonstrated leadership abilities, and management experience and effectiveness. Our other elements of compensation focus on motivating and challenging the executive to achieve superior, longer-term, sustained results. Each component of our compensation arrangements is addressed separately below.

Currently Paid Compensation Components

Salaries. The salary for each named executive officer reflects his or her management experience, length of service with us and the quality of his or her performance. Our Compensation Committee reviews each executive officer’s salary annually. For annual salary increases (particularly material ones), our Compensation Committee considers an executive’s increased level of experience, whether or not the executive’s responsibilities have increased over the past year or are in the process of being increased and the named executive officer’s job performance during the past year.

Bonuses. The Compensation Committee typically does not use bonuses as an incentive for performance for our executive management team (including our named executive officers). See “Compensation: Summary Compensation Table” below. Even though the Compensation Committee does not typically award bonuses, it has the power to do so.

Certain employees at some of the bank subsidiaries participated in incentive plans during 2012.2014. The guidelines of the incentive plans have been structured to minimize undue risk to the Corporation. Senior risk officers of the Corporation periodically review the incentive compensation arrangements and are comfortable that such arrangements do not encourage our employees to take unnecessary and excessive risks that threaten the value of the Corporation.

Perquisites. We provide perquisites on a selective basis to our executive management team members (including our named executive officers). There is no formula for how perquisites are utilized in the total compensation package; rather, such perquisites assist the Corporation in marginally augmenting total compensation. For example, a few of our executive officers have a company car because of the extensive traveling that they do in performing their duties for us; as an additional perquisite, we also pay for the portion of the car expenses attributable to their personal use. Please refer to “Compensation: Summary Compensation Table” below for the base salary, bonus and perquisite compensation for each of our named executive officers.

Long-Term Compensation Elements

Salary Savings Plan. We maintain a 401(k) plan that we have labeled as the “Salary Savings Plan” for our employees and our subsidiaries’ employees who have attained the age of 18 and have completed 30 days of service with us or with one of our subsidiaries.18. The Salary Savings Plan is administered by the Trust Department of our subsidiary Farmers Bank (the “Fund Manager”). The Salary Savings Plan provides for four types of contributions, as follows:

1. Voluntary tax-deferred contributions made by the participant;

2. Voluntary after tax-deferred contributions made by the participant into the Roth 401(k) portion of our Salary Savings Plan;

3. Matching contributions made by the Corporation; and

4. Discretionary contributions from the Corporation.

The benefits that a participant can ultimately expect to receive from the Salary Savings Plan are based upon the amount of the annual contributions made by us and the employee to his or her account together with the accumulated value of all earnings and losses on those contributions. A participant is permitted to make tax-deferred voluntary contributions under a salary reduction agreement. In 2009 we2014 the

employer matched upan amount equal to 50% of the participant’s elective deferral (up to a maximum of 6% of such participant’s compensation.eligible compensation); it is not expected to change in 2015. Our Compensation Committee views the matching contributions by us as a retention tool by virtue of the manner in which such matching contributions vest: two years of service, 20% vested; three years of service, 40% vested; four years of service, 60% vested; five years of service, 80% vested; and six years of service, 100% vested. The Salary Savings Plan participants are immediately vested in 100% of their contributions. The employer matching contribution was an amount equal to 50% of the participant’s elective deferral (up to a maximum of 6% of eligible compensation) in 2010, 2011 and 2012; it is not expected to change in 2013.

We have the right, in our sole discretion, to make additional contributions to the Salary Savings Plan on behalf of participants. We view this feature as a long-term compensation program for our named executive officers (as well as our other employees). Discretionary contributions are allocated among participants in the ratio that each participant’s compensation bears to all participants’ compensation. A participant’s contribution to the Salary Savings Plan is considered as part of the participant’s compensation for purposes of computing our contribution to the Salary Savings Plan. No discretionary contribution washas been made for 2009 through 2012in recent years and none is anticipated for 2013.

ESPP. Through our Employee Stock Purchase Plan (“ESPP”) our employees are offered the opportunity to set aside money each pay period through payroll deductions which will be used at a later time on designated offering dates to purchase shares of our common stock at a discounted price and without payment of brokerage costs or other fees. Our shares of common stock are offered at a 15% discount from the closing sales price of our shares of stock on NASDAQ as described in the plan document. Further, our employees may obtain favorable tax treatment by participating in the ESPP. Provided a participating employee holds his or her shares of our common stock purchased pursuant to the ESPP for a certain length of time, he or she will be entitled to receive capital gains taxation rather than ordinary income taxation upon the disposition or sale of such stock.

Our Board determines the eligibility criteria and offering dates for the ESPP. Currently, employees who have attained the age of 18 and who have completed one year of service are eligible to participate in the ESPP. For purposes of the ESPP, one year of service is more than 20 hours worked per week for twelve months. Further, an employee will cease to be eligible to participate in the ESPP if he or she will be deemed to possess 5% or more of our common stock. An eligible employee is also not permitted to purchase shares of our common stock under this plan at a rate that will exceed $25,000 in fair market value of our shares in a single calendar year.

Non-Qualified Stock Option Plan. We no longer grant any options under our Non-Qualified Stock Option Plan. However there remain unexercisedDuring 2014, the last of the outstanding options under the plan which may be exercised in the future. See “Compensation: Outstanding Equity Awardsexpired without being exercised. No options are outstanding at Fiscal Year End” for information respecting the unexercised outstanding options of our named executive officers.this time.

Employment Agreements:We typically do not enter into employment agreements with our executives. However,In 2012 our Compensation Committee determined that it was appropriate to enter into an employment agreement with our President and Chief Executive Officer in order to recognize Mr. Hillard’s exemplary efforts in leading us through thesethe past few economically difficult years and as a compensation vehicle to retain Mr. Hillard’s services for at least the next four years. The employment agreement assures him of continued employment for at least four years at a certain salary structure with some perquisites, but does not generally provide for lump sum payments. A one year extension was added to the contract in 2013 and another one year extension in 2014. The agreement doesnot provide for a payment upon a change in control and only provides a modest payment to his estate if he dies. The details of

Mr. Hillard’s employment agreement are described in “Employment Agreements” below.

In determiningemployment agreement in 2014. The details of the total compensation of our named executive officers, the employment agreements are described in “Employment Agreements” below.

Compensation Committee plays the key role. However, our PresidentPolicies and Chief Executive Officer recommendsPractices Relating to our Compensation Committee both the total pool for annual base salary increases for our executive management team and the individual annual base salaries for each executive officer. Risk Management:The Compensation Committee takes these recommendations into serious consideration when making final decisions on compensation for those senior officers. Compensation decisions regarding our President and Chief Executive Officer are made entirely by our Compensation Committee with ratification by the full Board of Directors.

Name and Principal Position | Year | Salary | All Other Compensation1 | Total |

Lloyd C. Hillard, Jr. President & CEO | 2012 2011 2010 | $369,402 350,000 318,788 | $11,559 14,499 24,367 | $380,961 364,499 343,155 |

James L. Grubbs President & CEO United Bank | 2012 | 185,000 | 16,719 | 201,719 |

Rickey D. Harp President & CEO Farmers Bank | 2012 2011 2010 | 185,000 182,000 182,000 | 15,061 15,172 15,112 | 200,061 197,172 197,112 |

Scott T. Conway. CEO First Citizens Bank | 2012 | 160,000 | 6,348 | 166,348 |

C. Douglas Carpenter EVP, Secretary & CFO | 2012 2011 2010 | 140,000 133,600 128,335 | 5,239 5,008 7,201 | 145,239 138,608 135,536 |

| Mr. Hillard | Mr. Grubbs | Mr. Harp | Mr. Conway | Mr. Carpenter | |

| Imputed car usage | $2,789 | $11,401 | $8,241 | $731 | $0 |

| 401(k) match | 7,500 | 4,269 | 5,550 | 4,431 | 4,200 |

| Option Awards | ||||

| Name | Grant Date | Number of Securities Underlying Unexercised Options That Were Exercisable at Year End | Option Exercise Price | Option Expiration Date |

Lloyd C. Hillard, Jr. President & CEO | - | - | - | - |

James L. Grubbs President & CEO United Bank | - | - | - | - |

Rickey D. Harp President & CEO Farmers Bank | 10/25/04 | 10,049 | $34.80 | 10/25/14 |

Scott T. Conway CEO First Citizens Bank | - | - | - | - |

C. Douglas Carpenter EVP, Secretary & CFO | - | - | - | - |

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in Column (a)) |

| (a) | (b) | (c) | |

Equity compensation plans approved by shareholders | 24,049 | $34.80 | 52,172 |

Equity compensation plans not approved by shareholders | N/A | N/A | N/A |

| Total | 24,049 | $34.80 | 52,172 |

| Directors | Fees Earned or Paid in Cash | All Other Compensation1 | Total | |

| J. Barry Banker | $15,500 | $- | $15,500 | |

| R. Terry Bennett | 26,0002 | 2,1893 | 28,189 | |

| Michael J. Crawford | 21,2504 | 24,4595 | 45,709 | |

| John R. Farris | 13,000 | - | 13,000 | |

| Dr. William C. Nash | 23,2006 | - | 23,200 | |

| David R. O’Bryan | 24,2007 | - | 24,200 | |

| Fred N. Parker | 9,000 | - | 9,000 | |

| David Young Phelps | 9,000 | - | 9,000 | |

| Marvin E. Strong | 28,5008 | - | 28,500 | |

| Fred Sutterlin | 9,500 | 139,6019 | 149,101 | |

| Shelley S. Sweeney | 12,500 | - | 12,500 | |

| Advisory Directors | ||||

| E. Bruce Dungan | 3,750 | - | 3,750 | |

| Dr. John P. Stewart | 4,000 | - | 4,000 | |

● | Salaries. Past salary surveys have verified that the salaries of the Corporation’s officers are not excessive, in comparison with peers, and we do not believe that there is anything in the salary compensation structure of the Corporation, or in the manner in which raises are awarded, that poses any unnecessary risk. |

● | Perquisites. The Corporation provides nominal perquisites to its senior management team and certain other officers. Because of the relatively small dollar amount of these perquisites and because they are not tied to any specific performance metrics, we do not believe that this element of compensation in any way encourages excessive or unnecessary risk taking. |

● | Salary Savings Plan (401(k)).Participation in our Salary Savings Plan is available to all employees as long as certain minimum conditions are met. We do not believe that participation in this plan encourages the taking of unnecessary and excessive risks because each employee has a choice of the type of fund in which he or she may invest his or her money, and such funds are broad based investment funds that may not include any investment in the Corporation. |

● | ESPP.Participation in our ESPP is available to all employees as long as certain minimum conditions are met. We do not believe that participation in this plan encourages the taking of unnecessary and excessive risks because (a) the value of the shares of our Common Stock in each employee’s individual account in the ESPP is tied directly to the market value of the Corporation’s common stock and will be enhanced to the extent the Corporation recognizes improved earnings over a longer period of time and (b) the tax code treatment of long-term versus short-term capital gains also encourages the recipients to hold the stock that they purchase, which discourages their taking short-term actions to improve earnings that may not have a more long-term effect upon the value of the Corporation. |

Process for Determining Compensation: We periodically review each component of the Corporation’s executive compensation program to ensure that pay levels are competitive and that any discretionary incentives are linked to Corporation performance targets such as: income, expenses, asset quality, operating margins, return on assets and return on equity. We place significant weight on the recommendations of our President and Chief Executive Officer, as well as economic conditions, our own experience and knowledge of market conditions, and peer group compensation surveys to provide additional information to support the compensation planning process. We occasionally hire a consulting firm to help us with this process, but we have not hired a consulting firm since 2008.

In determining the total compensation of our named executive officers, the Compensation Committee plays the key role. However, our President and Chief Executive Officer recommends to our Compensation Committee both the total pool for annual base salary increases for our executive management team and the individual annual base salaries for each executive officer. The Compensation Committee takes these recommendations into serious consideration when making final decisions on

compensation for those senior officers. Compensation decisions regarding our President and Chief Executive Officer are made entirely by our Compensation Committee with ratification by the full Board of Directors.

Our named executive officers, other than Mr. Hillard, Mr. Harp and Mr. Hampton, do not have employment, severance or change-of-control agreements. These officers serve at the will of the Board, which enables us to terminate their employment with discretion as to the terms of any severance arrangement. This is consistent with our performance-based employment and compensation philosophy. In addition, our policies on employment, severance and retirement arrangements help retain our executives by subjecting to forfeiture certain elements of compensation that they have accrued over their careers with us if they leave us prior to retirement.

Named ExecutiveCompensation

The following table sets forth all compensation for services in all capacities to the Corporation and its subsidiaries during the last three fiscal years for the Corporation’s Chief Executive Officer, Chief Financial Officer and the Corporation’s other three highest-paid Executive Officers (including for these purposes three persons not employees of the Corporation but of certain Corporation subsidiaries):

| Summary Compensation Table | ||||||||||||||

Name and Principal Position | Year | Salary | All Other Compensation1 | Total | ||||||||||

Lloyd C. Hillard, Jr. | 2014 | $ | 400,000 | $ | 12,291 | $ | 412,291 | |||||||

| President & CEO | 2013 | 385,000 | 13,127 | 398,127 | ||||||||||

| 2012 | 369,402 | 11,559 | 380,961 | |||||||||||

James L. Grubbs | 2014 | 200,000 | 17,649 | 217,649 | ||||||||||

| President & CEO | 2013 | 190,000 | 16,364 | 206,364 | ||||||||||

| United Bank | 2012 | 185,000 | 16,719 | 201,719 | ||||||||||

Rickey D. Harp | 2014 | 200,000 | 17,579 | 217,579 | ||||||||||

| President & CEO | 2013 | 190,000 | 12,819 | 202,819 | ||||||||||

| Farmers Bank | 2012 | 185,000 | 15,061 | 200,061 | ||||||||||

Scott T. Conway | 2014 | 175,000 | 13,226 | 188,226 | ||||||||||

| CEO | 2013 | 165,000 | 4,442 | 169,442 | ||||||||||

| First Citizens | 2012 | 160,000 | 6,348 | 166,348 | ||||||||||

C. Douglas Carpenter | 2014 | 155,000 | 5,770 | 160,770 | ||||||||||

| EVP, Secretary & CFO | 2013 | 145,000 | 5,435 | 150,435 | ||||||||||

| 2012 | 140,000 | 5,239 | 145,239 | |||||||||||

1The 2014 amount reflected in this column for each named executive officer includes (i) group term life insurance premiums, (ii) the following imputed costs of gas and car expenses related to the personal use of cars owned by us and used by some of our executive officers (“Imputed Car Usage”), and (iii) the Corporation’s matching contributions to each named executive officer’s voluntarily deferred salary contribution into his 401(k) plan:

Mr. Hillard | Mr. Grubbs | Mr. Harp | Mr. Conway | Mr. Carpenter | ||||||||||||||||

Imputed car usage | $ | 3,371 | $ | 10,479 | $ | 10,309 | $ | 8,118 | $ | - | ||||||||||

401(k) match | 7,650 | 6,000 | 6,000 | 3,838 | 4,650 | |||||||||||||||

C. Douglas Carpenter gave notice in October 2014 that he planned on retiring from the Company. The Board of Directors appointed Mark A. Hampton to be the Company’s Executive Vice President and Chief Financial Officer effective January 1, 2015. While Mr. Hampton will replace C. Douglas Carpenter as Chief Financial Officer, Mr. Carpenter will serve as Executive Vice President, Finance until the summer of 2015.

Outstanding Equity Awards at Fiscal Year End

All options remaining from a previous grant in 2004 expired in October 2014. No stock options for each of our named executive officers were outstanding as of December 31, 2014.

Option Exercises and Stock Awards Vested

None of the named executive officers exercised options during 2014.

Employment Agreements

As discussed in “Compensation Discussion and Analysis” above, we entered into an employment agreement on December 10, 2012 with Mr. Hillard. This employment agreement protects both us and Mr. Hillard by clarifying in advance each party’s expectations and rights regarding responsibilities, compensation and circumstances for termination. The Agreement began on January 1, 2013 and has an initial term of 48 months, with automatic one year extensions. Either party may choose to terminate an automatic extension of the agreement by providing written notice to the other party at least 90 days prior to the expiration of the initial term or the expiration of any subsequent extension. This agreement was extended one additional year on November 26, 2013 and again for one additional year on December 8, 2014.

Under the Agreement, Mr. Hillard will receive an annual base salary of $385,000 during the first twelve months and thereafter at an annual rate (not less than $385,000) to be determined by our Board. The rate for 2015 is $450,000. Mr. Hillard is entitled to reimbursement for the monthly charges for his personal smart phone and use of a company car (which will be replaced every three (3) years) of at least the quality of the Lincoln MKS currently being provided him. Mr. Hillard is entitled to participate in our employee benefit programs.

Under the Agreement, Mr. Hillard’s employment with us may only be terminated for (i) “Disability” which is defined as employee’s inability (due to physical or mental impairment) to perform his material duties for what can medically be expected to continue for twelve (12) months or (ii) “Cause,” which includes gross negligence in the performance of his duties, material breach of his fiduciary duties, alcohol or drug abuse or engaging in fraud, theft or dishonesty.

Mr. Hillard’s employment agreement contains provisions prohibiting him for a 3-year period following the termination of his employment from (a) soliciting our customers or (b) competing with us in the “financial industry” within the Commonwealth of Kentucky.

The employment agreements for Mr. Harp and Mr. Hampton are structured in the same manner as that of Mr. Hillard with a few variations. For Mr. Harp the initial term is twenty-four months beginning January 1, 2014, the annual base salary for the first twelve months is $200,000 and his company car is a Tahoe. Mr. Harp will be paid $210,000 in 2015. For Mr. Hampton the initial term is twenty-four months

beginning January 1, 2015, the annual base salary for the first twelve months is $155,000 and he does not have use of a company car.

Potential Payments upon Termination or Change-in-Control

None of our executive officers are entitled to receive a termination payment upon a change-in-control of the Corporation. Since we have employment agreements with Mr. Hillard, Mr. Harp and Mr. Hampton, they are each entitled to certain limited benefits in the event of the termination of his employment agreement for disability. If any of these three officers becomes disabled, as such term is defined in their employment agreement, he shall be entitled to an amount equal to his base salary for a period of three (3) months following the date of disability. Thus, if all three individuals became disabled in 2015, Mr. Hillard would receive an additional $112,500 in compensation; Mr. Harp would receive $52,500 and Mr. Hampton would receive $38,750.

Compensation of Directors

The following table summarizes the compensation we paid to our non-employee directors in 2014. For fees paid to our employee director, please refer to “Compensation: Summary Compensation Table” above.

Directors | Fees Earned or Paid in Cash | Stock Awards1 | All Other Compensation2 | Total | ||||||||||||

J. Barry Banker | $ | 12,625 | $ | 7,500 | $ | - | $ | 20,125 | ||||||||

R. Terry Bennett | 25,325 | 3 | 8,750 | 1,540 | 4 | 35,615 | ||||||||||

Michael J. Crawford | 26,975 | 5 | 7,500 | 8,348 | 6 | 42,823 | ||||||||||

John R. Farris | 9,500 | 6,500 | - | 16,000 | ||||||||||||

| Dr. William C. Nash | 28,850 | 7 | 7,500 | - | 36,350 | |||||||||||

David R. O’Bryan | 23,700 | 8 | 7,500 | - | 31,200 | |||||||||||

Fred N. Parker | 11,750 | 7,500 | - | 19,250 | ||||||||||||

David Y. Phelps | 9,250 | 7,500 | - | 16,750 | ||||||||||||

Marvin E. Strong | 28,950 | 9 | 7,500 | - | 36,450 | |||||||||||

Fred Sutterlin | 10,500 | 7,500 | 10,101 | 10 | 28,101 | |||||||||||

Judy Worth | 4,375 | 4,250 | - | 8,625 | ||||||||||||

Advisory Director | ||||||||||||||||